Indian EV Transition Policies

India's Electric Vehicle Policy Evolution (2013-2024)

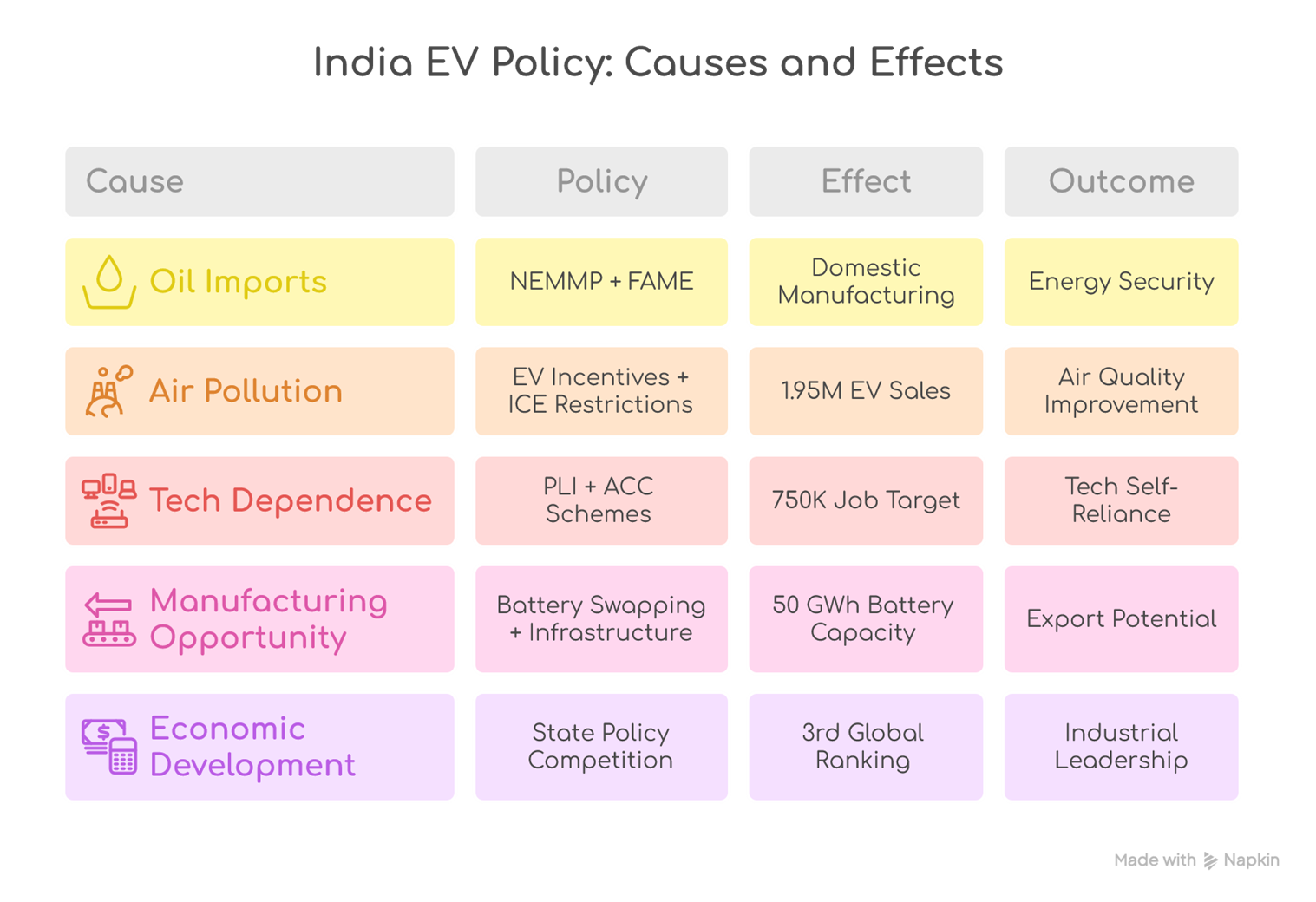

- India's electric vehicle policy landscape has undergone a dramatic transformation since 2013, evolving from a single mission plan to a comprehensive multi-level ecosystem spanning national, state, and local governance.

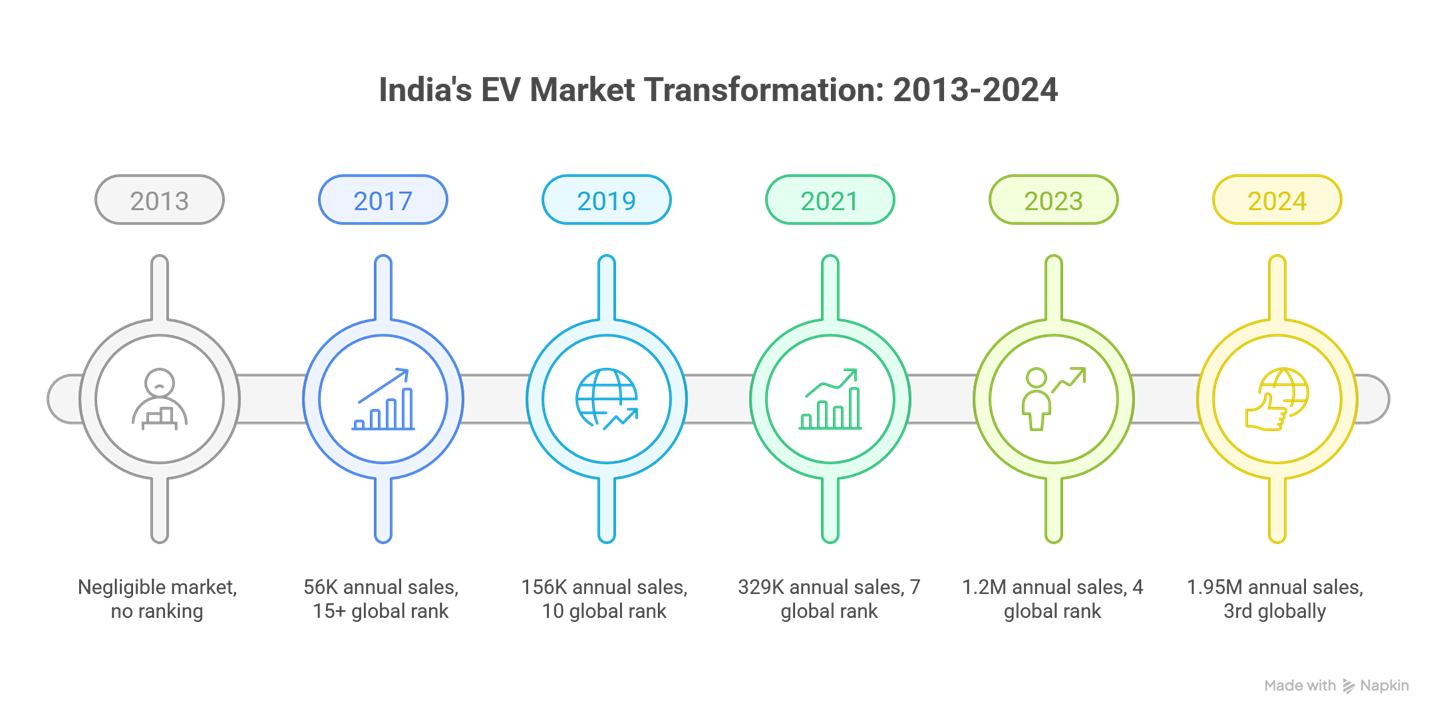

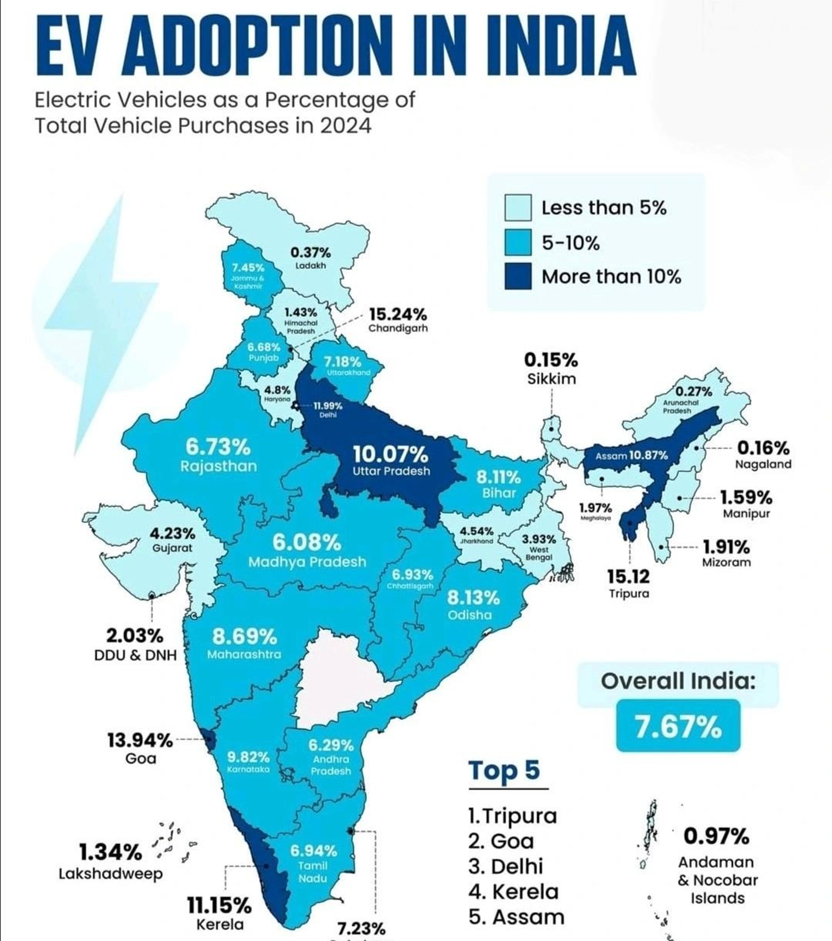

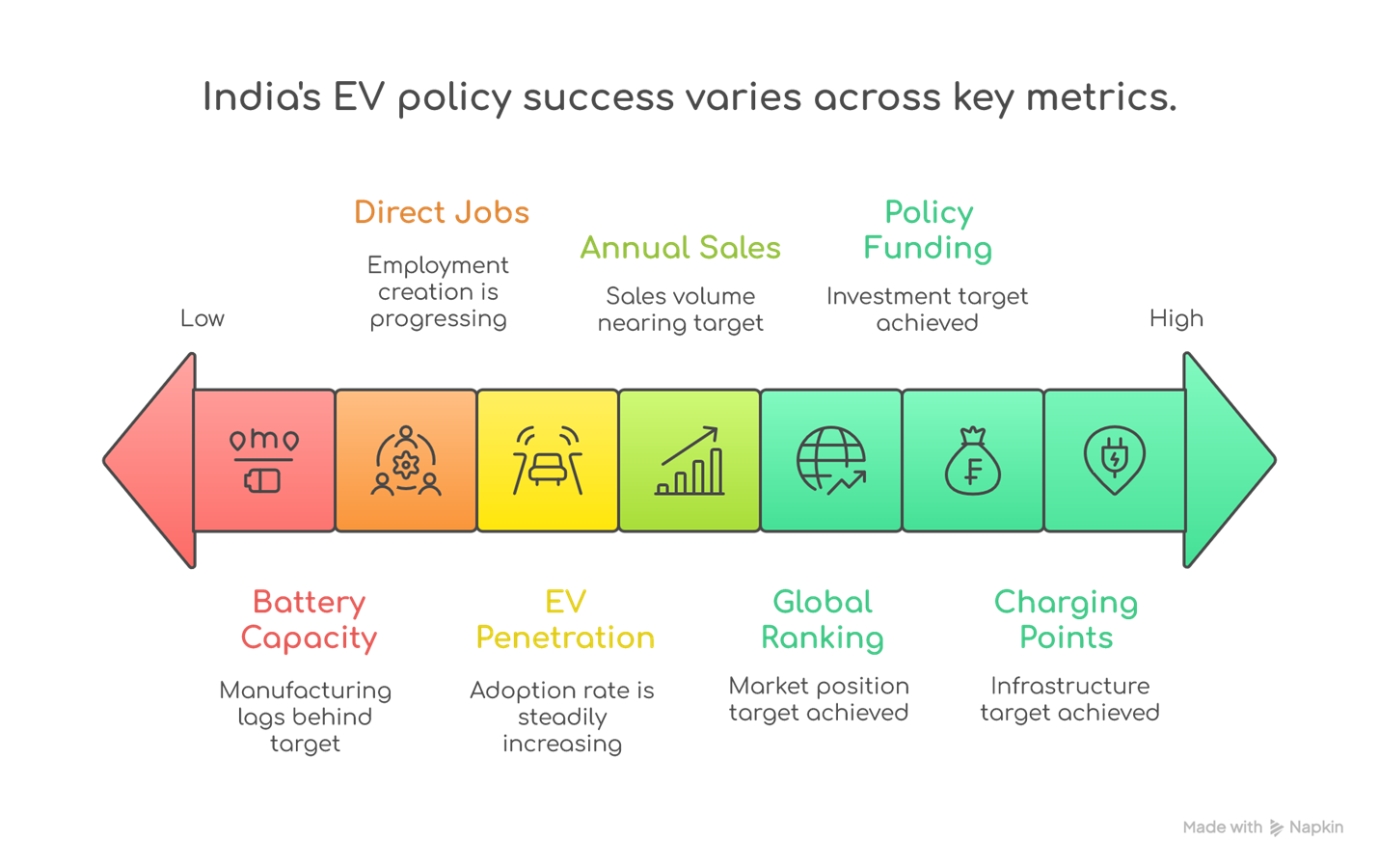

- This comprehensive policy framework has successfully catalyzed India's transition from negligible EV adoption to becoming the world's third-largest EV market by 2024, with EV sales reaching 1.95 million units annually.

- The systematic approach demonstrates how coordinated policy intervention across governance levels can accelerate technology adoption and industrial transformation.

- The policy evolution reveals a clear progression from vision to implementation, with each initiative building upon previous learnings while addressing emerging challenges.

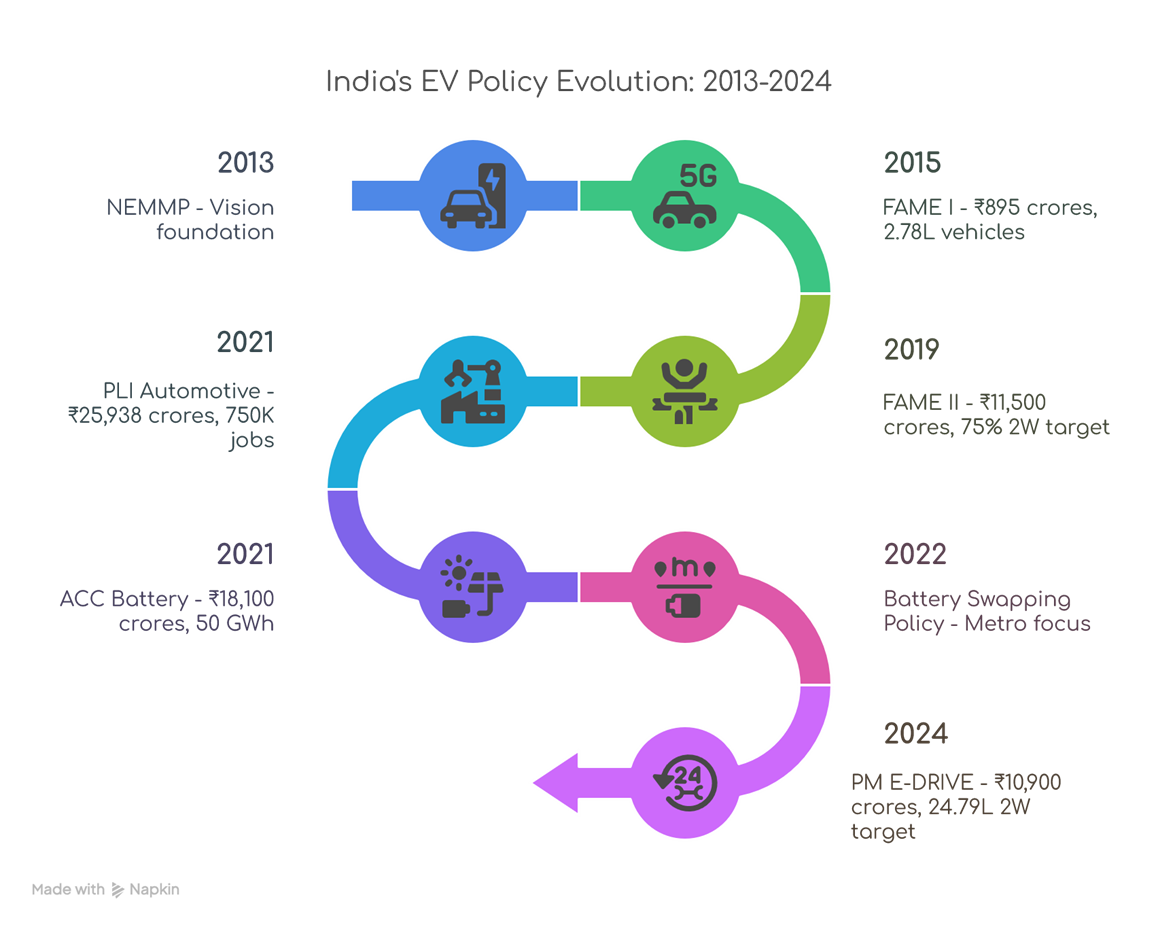

- Starting with the 2013 NEMMP's ambitious targets, the government has deployed over ₹75,000 crores across various schemes, creating an integrated ecosystem that addresses manufacturing, adoption, infrastructure, and technology development simultaneously.

1. NATIONAL/CENTRAL GOVERNMENT POLICIES

National Electric Mobility Mission Plan (NEMMP) 2020 - 2013

Cause:

- India's growing dependence on crude oil imports (₹62,000 crores annually), escalating air pollution crisis in urban areas, and the economic opportunity to develop India as an EV manufacturing hub drove this foundational policy.

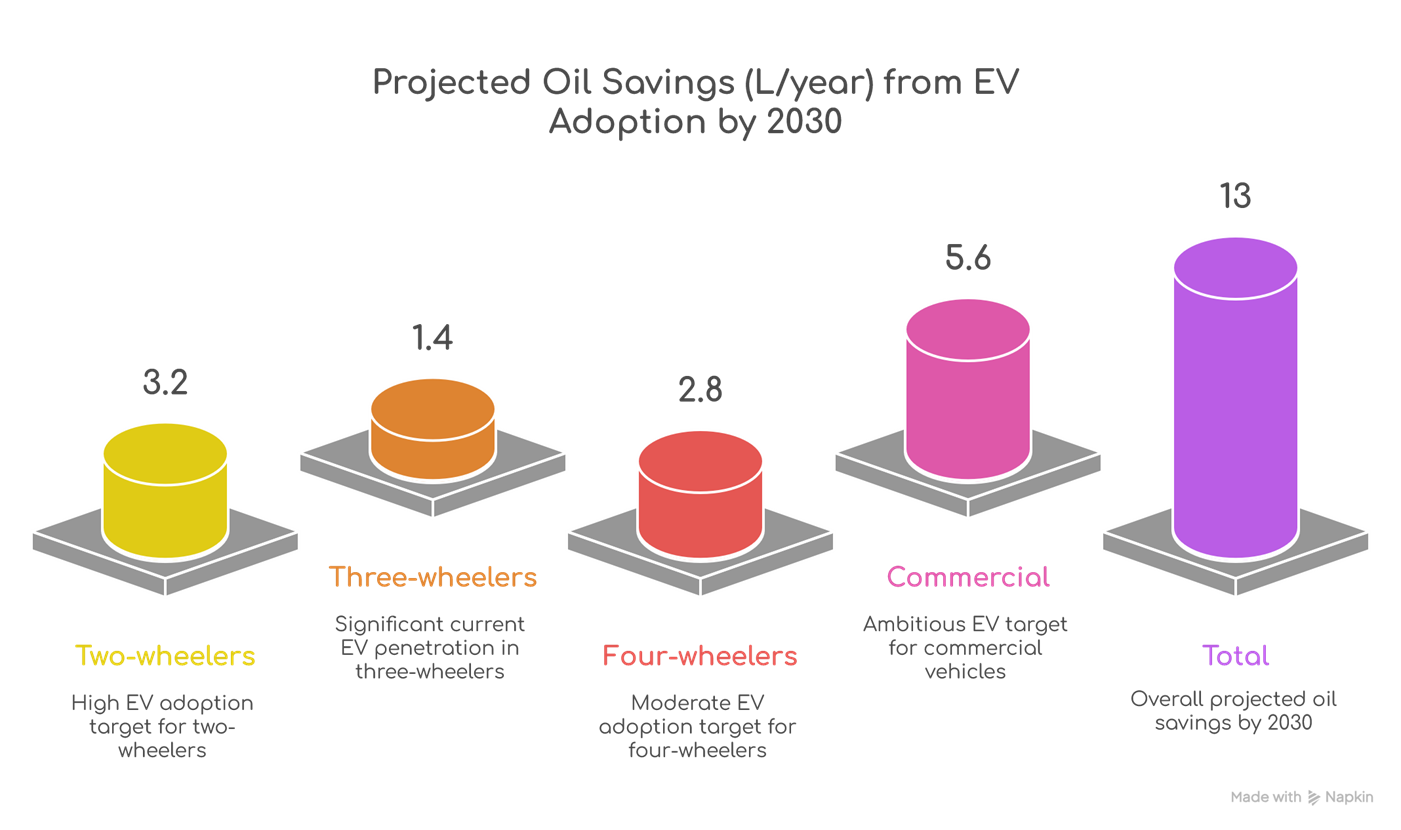

Effect: - Targeted 6-7 million electric/hybrid vehicle sales by 2020 with 5-10% market penetration, aiming to save 9,500 million liters of crude oil equivalent while promoting indigenous technology development.

Faster Adoption and Manufacturing of Electric Vehicles (FAME) I - 2015

Cause:

- The implementation gap between NEMMP's vision and ground reality, coupled with high upfront costs preventing adoption and lack of charging infrastructure, necessitated concrete operational framework.

Effect: - Incentivized 2.78 lakh electric/hybrid vehicles with ₹895 crores, supporting 465 buses across cities while creating demand through four focus areas: technology development, demand creation, pilot projects, and charging infrastructure.

National Mission on Transformative Mobility and Battery Storage - 2019

Cause:

- Coordination challenges across ministries, manufacturing gaps in domestic battery capabilities, and heavy import dependence on EV components required integrated approach.

Effect: - Established inter-ministerial coordination for phased manufacturing program, focusing on giga-scale battery manufacturing and complete EV value chain localization.

FAME II - 2019-2024

Cause:

- FAME I's limited scope and impact, insufficient public charging network, and need to focus on commercial vehicle electrification and higher technology standards.

Effect: - With ₹11,500 crores budget, achieved 75% target for two-wheelers, 84% for three-wheelers, and sanctioned 2,636 charging stations across 62 cities, becoming India's largest EV promotion scheme.

Production Linked Incentive (PLI) Scheme for Automotive Sector - 2021

Cause:

- Need to overcome manufacturing cost disabilities, integrate into global automotive value chains, and focus on Advanced Automotive Technology while generating employment.

Effect: - ₹25,938 crores scheme targeting 750,000 direct jobs in auto sector, focusing on Zero Emission Vehicles with 50% Domestic Value Addition requirement.

National Programme on Advanced Chemistry Cell (ACC) Battery Storage - 2021

Cause:

- Over 80% lithium-ion battery imports from China/South Korea, supply chain vulnerabilities, and negligible domestic manufacturing capacity.

Effect: - ₹18,100 crores program targeting 50 GWh cumulative capacity, reducing annual imports by ₹20,000 crores while achieving 60% domestic value addition in 5 years.

Battery Swapping Policy - 2022

Cause:

- Urban space constraints limiting charging stations, consumer range anxiety, commercial vehicle efficiency requirements, and need for Battery-as-a-Service models.

Effect: - Prioritized metropolitan cities with 40+ lakh population, focusing on two-wheelers and three-wheelers with standardized interoperable batteries.

Vehicle Scrappage Policy - 2021

Cause:

- Need to remove old polluting vehicles, eliminate unfit vehicles causing accidents, provide economic stimulus post-COVID, and promote automotive material recycling.

Effect: - Mandatory fitness testing for commercial vehicles >15 years and private vehicles >20 years, with incentives including 4-6% purchase discounts and 25% road tax rebate.

GST Reductions for Electric Vehicles - 2017-2019

Cause:

- Price parity requirements between EVs and ICE vehicles, demand stimulation needs, and tax policy alignment with clean transportation goals.

Effect: - Reduced EV GST to 5% from 12% while maintaining 28% + cess for ICE vehicles, creating significant cost advantages for EV consumers.

Import Duty Reductions - 2019 & 2024

Cause:

- Encouraging global manufacturers to set up assembly operations, attracting advanced technologies, enabling premium EV imports, and encouraging foreign investment.

Effect: - 2019 reductions enabled CKD/SKD operations; 2024 SPMEPCI allows 8,000 premium EV imports at 15% duty with ₹4,150 crores minimum investment requirement.

Scheme to Promote Manufacturing of Electric Passenger Cars in India (SPMEPCI) - 2024

Cause:

- Facilitate global manufacturers like Tesla, position India as global EV manufacturing destination, bring advanced technologies, and attract large-scale foreign investment.

Effect: - ₹4,150 crores minimum investment threshold with 8,000 premium EV import facility, requiring local manufacturing within 3 years and 50% Domestic Value Addition(DVA) in 5 years.

PM Electric Drive Revolution in Innovative Vehicle Enhancement (PM E-DRIVE) - 2024

Cause:

- Continuity after FAME II expiry, segment diversification including ambulances and trucks, charging infrastructure scaling, and focus on advanced battery technologies.

Effect: - ₹10,900 crores scheme targeting 24.79 lakh two-wheelers, 3.16 lakh three-wheelers, 14,028 buses, plus 22,000+ chargers with reduced subsidy structure promoting market maturity.

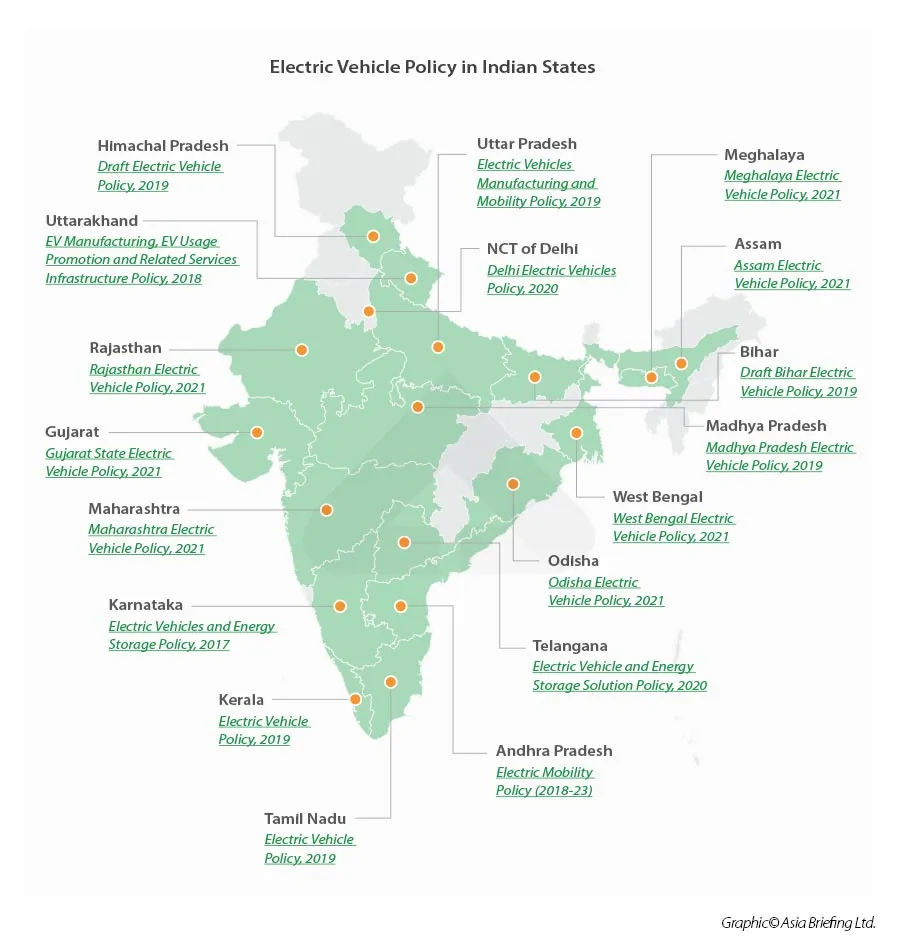

2. STATE GOVERNMENT POLICIES

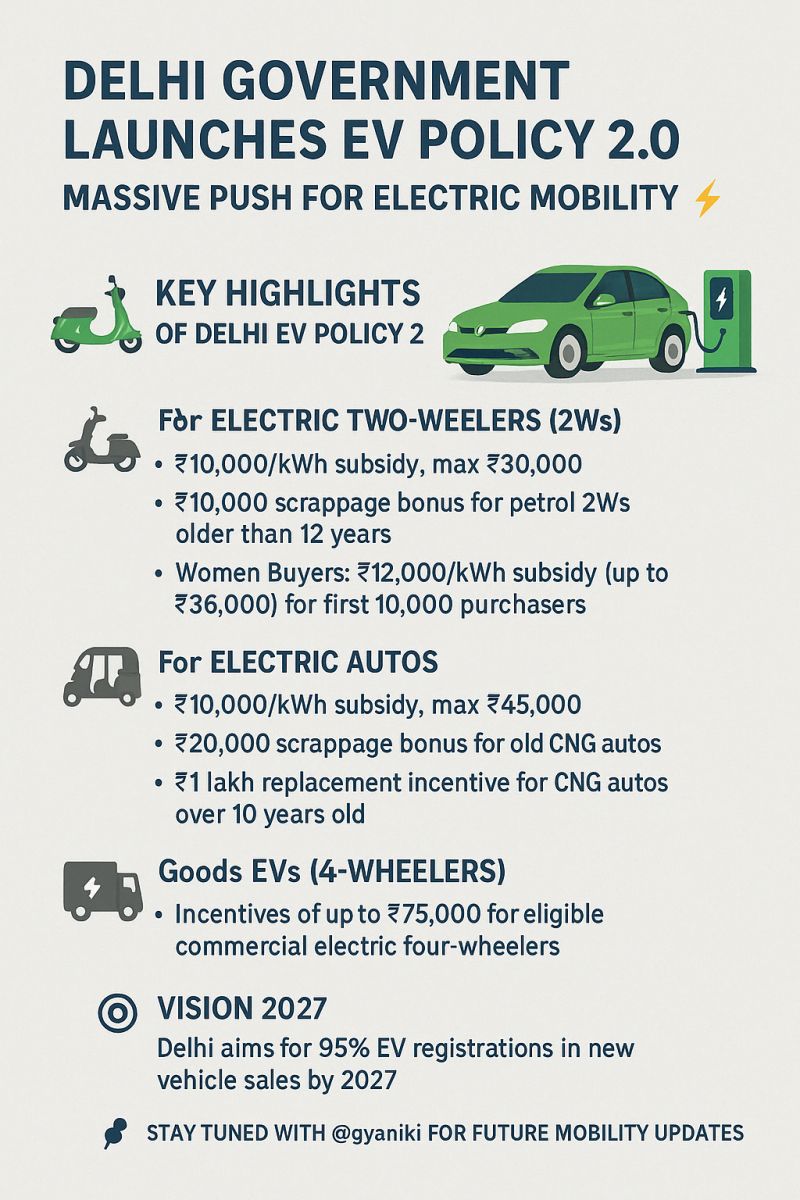

Delhi: Pioneer in urban EV adoption

- Delhi's Electric Vehicle Policy 2020 (revised to EV Policy 2.0 in 2025) offers up to ₹30,000 for two-wheelers and ₹1.5 lakh for four-wheelers with comprehensive road tax exemptions.

- The policy was driven by severe air pollution where vehicular emissions account for 22-26% of pollution, making emission reduction urgent.

- Delhi aims for 95% EV penetration by 2027, having achieved 13-14% adoption and planning 13,200 charging stations to become the world's leading EV adoption city.

Maharashtra: Manufacturing leadership transition

- Maharashtra's Electric Vehicle Policy 2021 provides 15% subsidy with ₹10,000 cap for two-wheelers and ₹1.5 lakh for four-wheelers, backed by ₹930 crore allocation.

- The state leveraged its automobile manufacturing leadership while addressing urban air pollution to maintain industrial competitiveness.

- The policy targets 10% of new registrations as EVs by 2025, establishing gigafactory capabilities and achieving 25% public transport electrification.

Gujarat: Highest per-kWh incentives

- Gujarat's Electric Vehicle Policy 2021 offers India's highest per-kWh subsidy at ₹10,000/kWh with complete registration fee waiver and 25% capital subsidy for charging stations.

- The policy leverages Gujarat's industrial leadership and petrochemical expertise to become India's EV manufacturing hub while reducing fuel import dependency.

- Gujarat targets 200,000 EV sales by 2025 with 528 charging stations, aiming for ₹5 crore state fuel expenditure reduction.

Karnataka: First-mover advantage

- Karnataka's Electric Vehicle Policy 2017, India's first state EV policy, provides 15% capital investment subsidy for manufacturers with complete tax exemptions.

- The policy leveraged Bengaluru's tech ecosystem and automotive manufacturing base while addressing urban air pollution.

- Karnataka established itself as an EV manufacturing hub, targeting 50% government vehicle electrification by 2025 while attracting major global investments.

Tamil Nadu: Automotive market leadership

- Tamil Nadu's Electric Vehicle Policy 2023 offers 100% road tax exemption till 2025 with zero registration charges and dedicated EV parks.

- The policy leverages Tamil Nadu's position as India's second-largest vehicle market (2.77 crore vehicles) and automotive manufacturing strength.

- The state targets ₹50,000 crore investment creating 1.5 lakh jobs while establishing India's first dedicated EV manufacturing ecosystem park.

Telangana: Smart city transformation

- Telangana's Electric Vehicle Policy 2020 provides 100% road tax and registration fee exemption for targeted vehicle segments with capital subsidies up to ₹30 crore for manufacturers.

- The policy transforms Hyderabad into a smart city with reduced pollution while attracting manufacturing investments.

- Telangana aims for significant EV penetration across all segments while establishing itself as a preferred manufacturing destination.

Uttar Pradesh: Scale advantage utilization

- UP's Electric Vehicle Policy 2022 offers road tax exemptions and registration fee waivers with single-window clearance and manufacturing incentives.

- The policy leverages UP's large market size and existing automotive infrastructure to become India's largest EV manufacturing hub.

- UP targets ₹30,000 crore investment generating 10 lakh jobs while improving air quality in major cities.

West Bengal: Industrial heritage leverage

- West Bengal's Electric Vehicle Policy 2021 provides special EV tariff at ₹6/kWh with 100,000 charging stations target and R&D grants.

- The policy leverages West Bengal's industrial heritage and Kolkata's urban transport challenges to lead electric mobility ecosystem development.

- The state targets 10 lakh EVs by policy end, aiming for top-3 EV penetration status and best state recognition by 2030.

Other significant state policies

- Rajasthan focuses on economic diversification while addressing air pollution in major cities, targeting manufacturing hub status.

- Andhra Pradesh emphasizes fast-track adoption with comprehensive manufacturing incentives and integrated ecosystem development.

- Kerala addresses coastal area pollution while supporting sustainable tourism through clean transportation.

- Bihar creates manufacturing ecosystem while positioning as preferred investment destination.

- Haryana leverages Delhi NCR proximity and automotive base for manufacturing hub development.

3. LOCAL BODY POLICIES

Delhi EV Policy 2020: World's most progressive local framework

- The Government of NCT of Delhi implemented India's most comprehensive local EV policy driven by severe air pollution where vehicular emissions contributed 22-26% of pollution.

- Delhi achieved 12.5% EV penetration by March 2022 versus 4% national average, introducing India's first "feebate" system taxing polluting vehicles to fund EV incentives.

- The policy created single-window clearance for charging stations and became an international model for progressive EV policies.

Statue of Unity EV-Only Zone: India's first emission-free zone

- The Statue of Unity Area Development Authority created India's first EV-only zone in June 2021 to establish a zero-emission tourist destination around the world's tallest statue.

- The zone deployed 50+ e-rickshaws with renewable energy charging from hydroelectric plants, converting all official vehicles to EVs and becoming a model for eco-friendly tourism zones.

BEST Mumbai Electric Bus Fleet: Early public transport pioneer

- BEST Mumbai started electric bus adoption in 2014-2015 with major expansion from 2020, driven by air pollution from diesel buses and Maharashtra's sustainable transport commitment.

- BEST targets 100% electric fleet by 2027, ordering 2,100 electric buses worth ₹36,750 crores and deploying India's first electric double-decker AC bus, becoming a model for nationwide bus electrification.

Ahmedabad BRTS Electric Integration: World's first electric BRT system

- Ahmedabad Municipal Corporation integrated 180 electric buses into the acclaimed BRTS system starting 2021, making it the world's first electric BRT system.

- Each bus saves 1,000 tons of CO2 and 350,000 liters of diesel over 10 years with 250km range per charge, establishing a comprehensive end-to-end e-mobility ecosystem.

Mumbai EV Cell: Innovative public-private partnership

- BMC established India's first dedicated EV cell in February 2022 with WRI India to address Mumbai's transport sector contributing 25% of greenhouse gas emissions.

- The cell supports BEST's 100% electric fleet transition while developing Mumbai's Climate Action Plan, creating a replicable model for other cities.

- Currently those targets seem to have been revised to a longer timeframe

Delhi EV Policy 2.0: World's most ambitious local

- Expected in April 2025, Delhi's updated policy targets 95% EV penetration by 2027 and 98% by 2030, with complete ICE three-wheeler ban from August 2025 and two-wheeler ban from August 2026.

- The policy includes mandatory third car rules requiring household's third car to be electric, representing the world's most ambitious local EV transition.

Strategic evolution and future trajectory

- India's EV policy evolution demonstrates sophisticated policy learning and adaptation.

- The progression from NEMMP's ₹14,000 crores vision to current cumulative allocation exceeding ₹75,000 crores reflects growing government commitment and policy sophistication.

- The integration of manufacturing incentives (PLI, ACC), adoption support (FAME, PM E-DRIVE), infrastructure development (battery swapping, charging networks), and regulatory framework (GST, import duties) creates a comprehensive ecosystem approach.

- The state-level policy proliferation since Karnataka's 2017 pioneering effort shows competitive federalism driving innovation, with each state adapting policies to local contexts while maintaining national coordination.

- Local body innovations like Delhi's feebate system and Mumbai's dedicated EV cell demonstrate ground-level policy experimentation creating scalable solutions.

- Current policy trajectory indicates maturation from subsidy-dependent adoption to market-driven growth, with recent schemes reducing incentive levels while expanding infrastructure and manufacturing support.

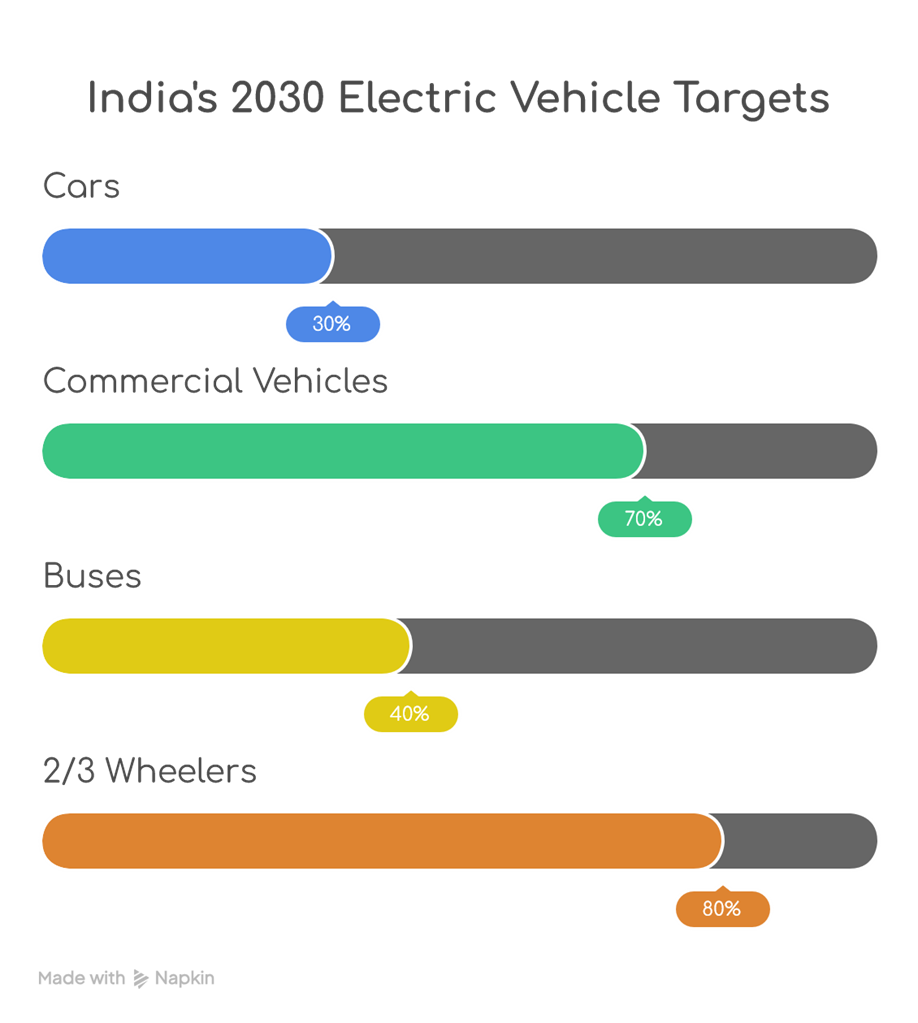

- The 2030 targets of 30% private cars, 70% commercial cars, 40% buses, and 80% two/three-wheelers electrification remain ambitious but achievable given current policy momentum and implementation excellence demonstrated across governance levels.